Crafting Compelling Cold Emails: A Startup’s Guide to Raising with Cold Emails

Raising funds is always hard. Asking investors for money is even harder. How to pitch investors via cold emails when you’re not a 100M ARR startup?

Not long ago, after we started researching the topic, our PMM lead, Lisa Dziuba, shared the email that once helped her startup raise an $850K seed round. After that, we’ve decided to give more examples of successful cold emails that lead to funding.

In this article, we’ve collected the most helpful tips and tricks on cold emails from founders and investors — hoping they will help you get a reply from investors.

How to do it?

Lisa Dziuba (ex-startup founder, PMM & growth lead at startups)

- Build trust with the accelerators, angel investors, or VCs you aim at.

Make your homework by researching investors’ main focus, previous rounds, and professional backgrounds. Pitch those who can be potentially interested in you. Follow them on social media, comment on their articles, subscribe to their podcasts, research their business and personal interests, and find points you can relate to. - Make your email personal.

Tailor all your findings to the cold email. Can you mention that your startup is in the same area as the previous investments? Can you refer to the professional experience of the VC that is super relevant to your business? Or maybe you are attending the same conference the VC General Partner will speak at? (you are definitely attending it 🙂 - Think over your value proposition.

Why should they finance your growth? Most VCs want well-oiled traction, promising markets, and efficient teams. Make your strengths clear. - Add social proofs.

Collect relevant statistics (e.g., average time spent in your app) and beneficial data (tools you integrated your app with, partner marketplaces, dev team size, markets you’ve entered). The more traction, the better.

Now, let’s look into other recommendations from startup owners that successfully raised funds with cold emails and see what they have to recommend to fellow startup owners.

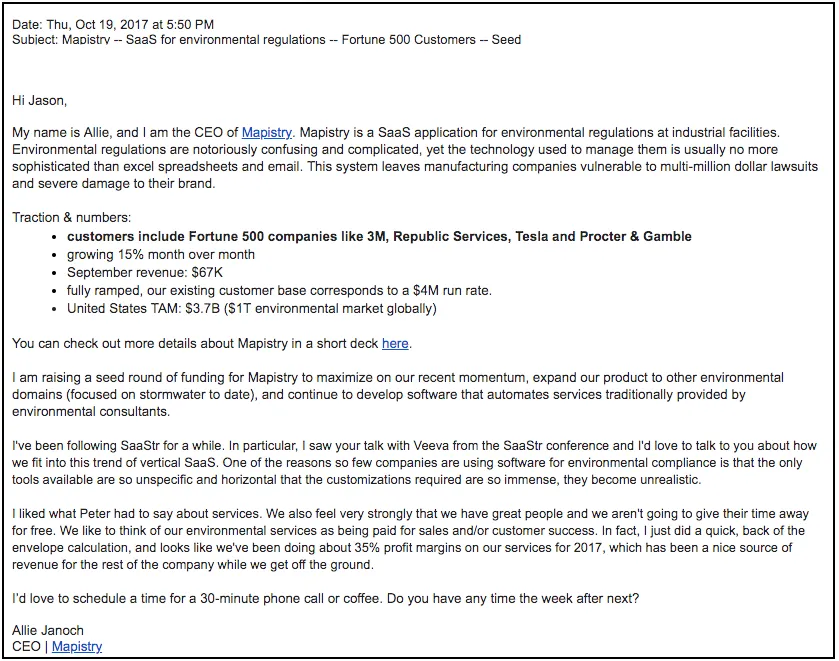

Allie Janoch (CEO and Co-founder of Mapistry)

Allie’s way to venture capital wasn’t successful right from the start. Her first try to get a meeting with Jason Lemkin from SaaStr (you’ll come across his advice later on in this article) went unanswered. She read Jason’s articles, attended his lecture at UC Berkeley, asked him one question, and wrote a brief follow-up email. The first pancake turned lumpy — but Allie didn’t give up. She made her homework, tried again two years later — and succeeded.

Here’s what she advises:

- Use the subject line to describe your company in a few words (“SaaS for environmental compliance”) and state the aim of your mail.

- In the initial paragraph, explain what you do. VC capitalists never have the founders’ problems. To get money for solving them, pitch your problems first.

- Add impressive facts and stats, organizing them into a digestible bullet list. Think them over and pick the most telling ones.

- Share your plan for spending the money you’re looking for.

- Never use the same template for more than one investor. Each VC should get a personal attitude and content. Explore their business history and find potential discussion points.

- Wind it up with a request for a 30-minute call or coffee meeting. (If your meeting goes well, it will surely last longer.)

Here’s the email that brought Allie’s company a staggering $2,5M:

This is a solid example of a well-written email; according to the author, it got a response in a few hours! Let’s see what other entrepreneurs have to say!

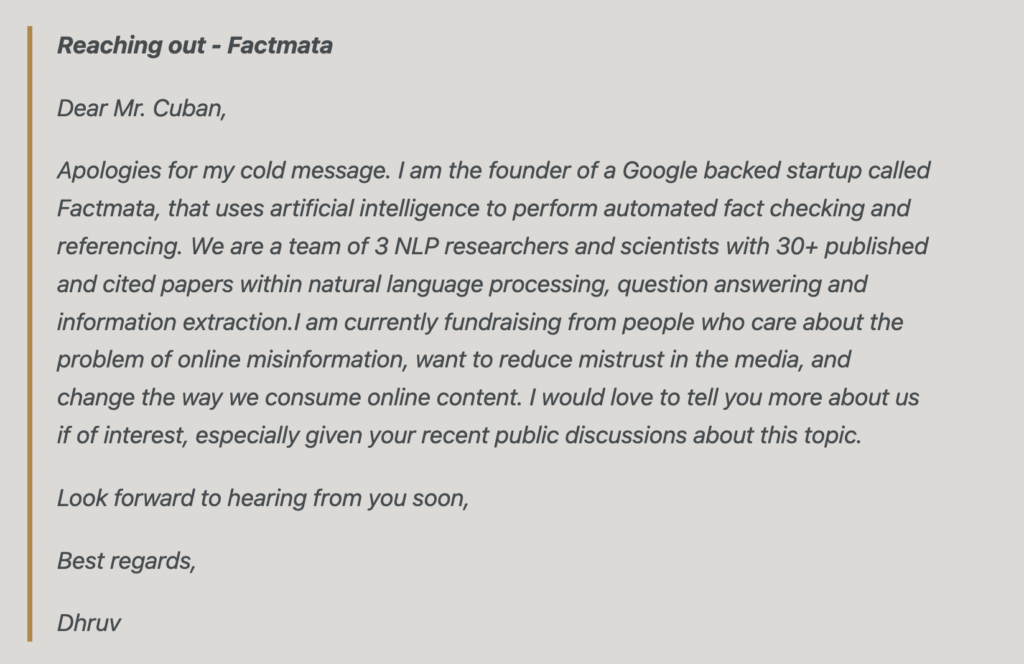

Dhruv Ghulati (CEO and Co-Founder of Factmata)

After writing well-crafted cold intro emails, Dhruv Ghulati raised a $1m seed round from Mark Cuban (Dallas Mavericks owner), Biz Stone (Twitter co-founder), Mark Pincus (Zynga founder), and Craig Newmark (Craigslist founder).

Here’s his advice on writing cold emails:

- Education, work experience, and credible achievements will help you build credibility in the eyes of potential investors.

- After a thorough market analysis, you’ll have confident credibility in the field of spending the funds.

- Before reaching out to investors, work on prototypes, contract examples, and product research. Material progress sells better than sheer plans.

- Aim at investors who are emotionally involved with your business domain.

- In your email, explain why you target this person and why your business should matter to them.

- If you don’t get anything back, send a follow-up email.

- Focus your discussion on reaching objectives in the framework of the company economics, not on products.

Here’s the email raising $1M for Dhruv and his Factmata startup:

Dhruv Ghulati had no intro and no network. But his brilliant cold emails and persistence helped him get through to Mark Cuban and the elite of Silicon Valley.

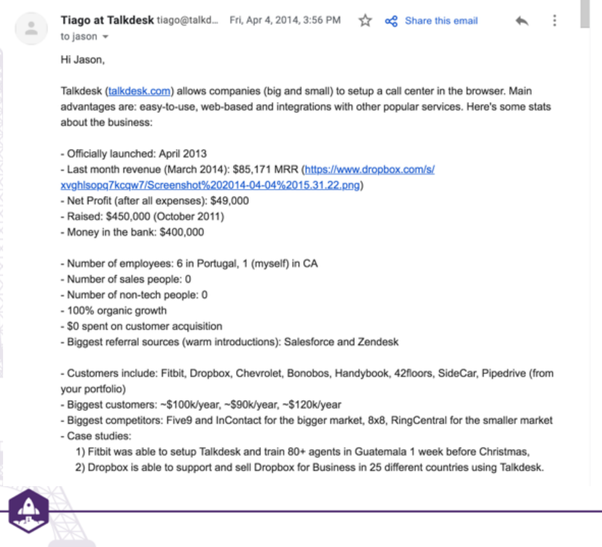

Jason Lemkin (SaaStr CEO, SaaStr Fund Managing Director)

Jason Lemkin learned the hard way how to craft a good email. Even though he managed to turn a cold email into a whopping $2.5M seed round, he admits that his first cold emails did not work at all.

However, here’s what he recommends based on his later experience:

- Plan your timing and pitch your product when VPs get interested in your kind of products.

- Provide potential investors with a discernible development strategy outline and the case studies proof. If you still don’t have them, plan them and share your plans.

- Lame email pitches written with no previous research never work.

Today, Unicorn Talkdesk is worth more than $3 billion. Back in the days before this email was written, the company raised $450 000.

Though the image is slightly blurry, the text of this email is clear, strong, and data-driven. Any investor reading it would love to meet with the person behind it.

Elizabeth Yin (HustleFund VC co-founder)

While the previous experts shared longer emails as an example of a compelling cold email, Elizabeth Yin chose a “short and sweet” one she found interesting.

Here are her tips on how to best approach an investor through a cold email:

- Cold intro emails aim at getting a meeting, not getting funding. You should make the investor interested.

- Bullet points with good spacing make it easier to see notable things in the founders’ domain.

- Startuppers’ FOMO (fear of missing the next seeding round) can also work on some investors.

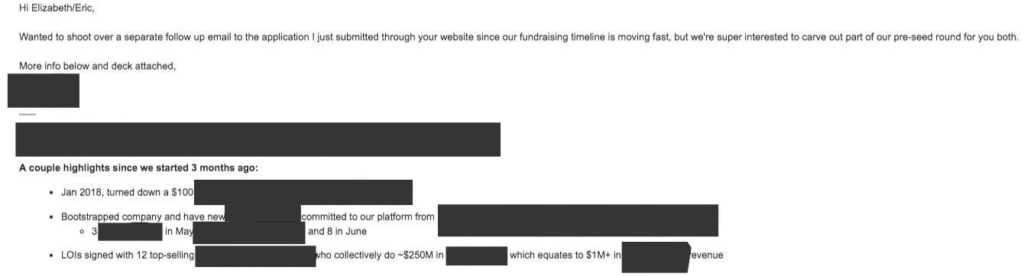

Here’s an example of the email allowing its authors to get a seed round at HustleFund:

Joe Speiser (partner at Hampton VC, formerly CEO and co-founder of LittleThings)

Joe Speiser raised more than $20M for his startups with the help of cold emails — and now he made a public Twitter thread with tips for each step of the process. You have two options: read it all there in full, or imbibe the distilled wisdom below.

- Find interesting investors. Use Crunchbase to look for direct competitors — and research their investors.

- Find their emails via Investor Fund (or try guessing them by putting together the company name and the name of its founders).

- Create a list of 200-300 investors, and rank them by how willing you are to lose them.

- Draft an email sequence. Focus your pitch on two key questions.

- Follow at least two times with each person and improve your pitch for every new iteration.

Martins Lasmanis (CEO of Supliful)

He raised a $400k investment in 5 days. Sounds almost incredible, but the task appears to be quite tangible if you know the efficient winning scheme.

- Source and filter the investor leads (possible criteria: funding stage, investment focus, financing limitations);

- Draft a cold email;

- Use multiple touch points to reiterate your story (LI, 2nd email, LI invite, 3rd email);

- Use automatic tools to create efficient sequences (e.g., Lemlist).

Well-crafted cold emails are efficient ice-breaking business tools — if you know how to handle them. Make them work for you — and good luck in the next seed round!