The software development industry is evolving rapidly. Emerging technologies, shifting market demands, and a growing talent gap make it harder for businesses and developers to stay competitive.

But the industry is still growing, with revenues projected to reach $896.17 billion by 2029. Companies that don’t embrace change risk missing key hiring, compensation, and specialization opportunities.

Whether hiring a software developer or refining your hiring strategy, the following software development statistics highlight key market trends, talent demands, and growth opportunities to keep you ahead.

Software Development Market Statistics

Despite fluctuations over the years, the software market continues to expand, with businesses increasingly hiring talent outside the U.S., particularly developers in Eastern Europe and other regions.

Here are some key statistics highlighting these trends:

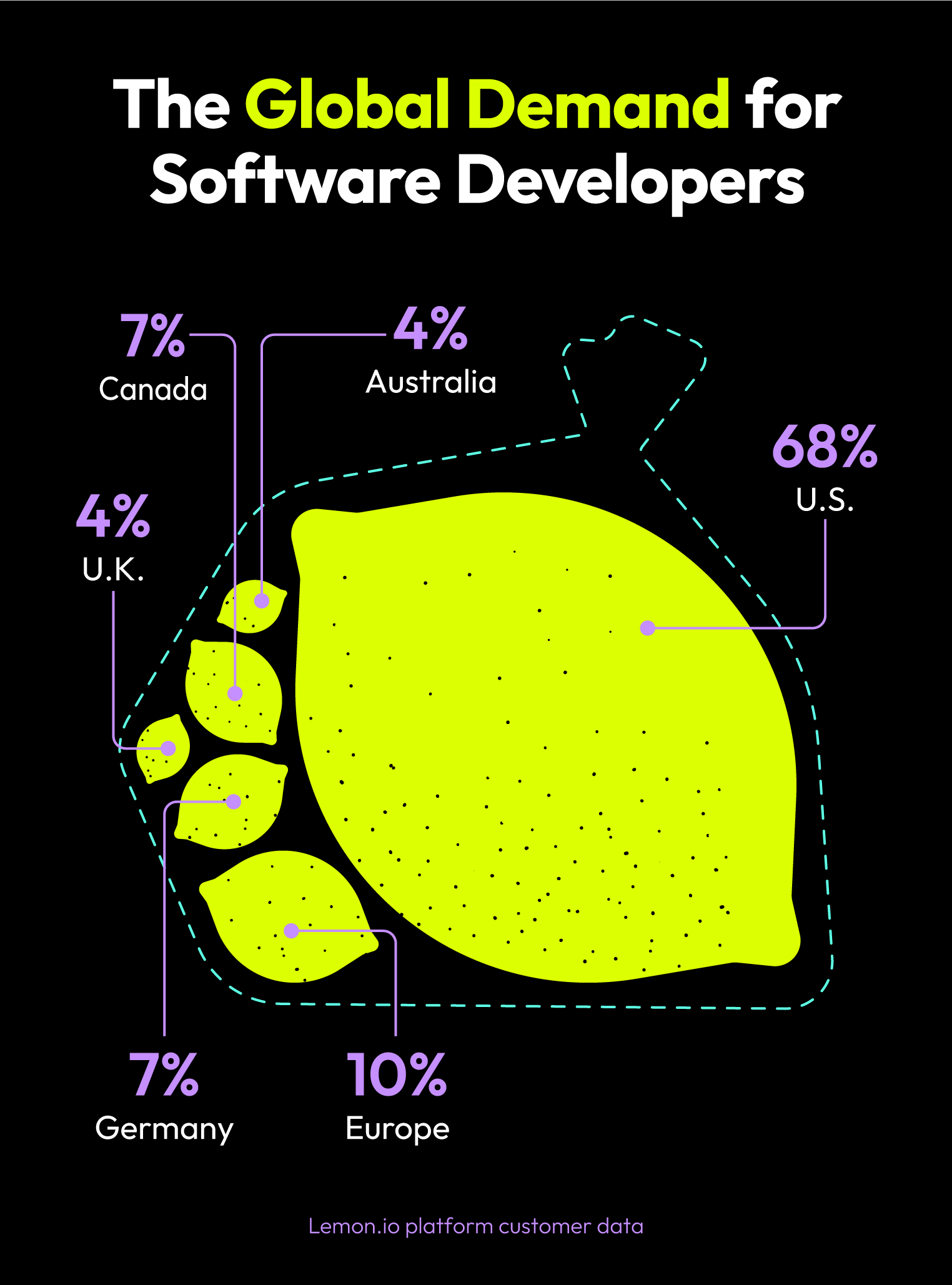

- Lemon.io’s client base is evidence of the global demand for software developers, with 68% in the U.S., 7% in Canada, 7% in Germany, 4% in Australia, 4% in the U.K., and 10% in other areas of Europe.

- The worldwide software market is expected to reach approximately $741 billion by 2025.

- Software growth is anticipated to continue, with revenues projected to reach $896 billion by 2029, reflecting a compound annual growth rate (CAGR) of 4.87% from 2025 to 2029.

- The enterprise segment of the software market is forecasted to generate revenues of $315 billion by 2025.

- The application development software market is projected to reach $196 billion in revenue by 2025.

- The United States is expected to maintain a leading position in the software market, with projected revenues of $380 billion at the end of 2025.

- The global software market size accounted for $737 billion in 2024 and is expected to reach around $2.25 trillion by 2034, expanding at a CAGR of 11.8% from 2024 to 2034.

- The North American software market size reached $276.85 billion in 2023.

- Major tech companies are increasingly seeking programmers proficient in AI tools, as AI-driven coding assistants have attracted nearly $1 billion in funding since early 2023, enhancing developer productivity by 20%-35%.

Software Development Industry Career Statistics

While the global software market continues to grow, the career outlook and demand for software development outsourcing tell a more complex story, one that can impact your choice between outsourcing and outstaffing.

- Despite steady lead volume and a consistent vetting process, Lemon.io has seen a decline in processed leads, reflecting a shift toward narrower tech stacks and seniority levels due to lower client demand. In 2022, Lemon.io processed 36% of incoming leads. This dropped to 14% in 2023 and 7% in 2024.

- Despite a steady flow of incoming leads, Lemon.io has noticed a decline in demand for software developers as companies scale back hiring—noting a sharp decline in the percentage of leads converting to onboarded hires, from 1.49% in 2022 to 0.75% in 2023 and 0.31% in 2024.

- Lemon.io has seen an increase in candidates attempting to fake their identities (e.g., use false credentials or impersonate others) as job opportunities become scarcer. In 2022, such cases accounted for 0.096% of leads (39 cases), rising to 0.25% (90 cases) in 2023. While the total dropped to 0.087% (34 cases) in 2024, the overall increase compared to earlier years remains notable.

- Lemon.io finds the number of candidates who refuse to continue the hiring process due to unmet rate expectations fluctuates and despite decreasing in 2024 remains higher than in earlier years. In 2022, 0.41% of leads turned into refusals, which rose to 1.36% in 2023. In 2024, the refusals decreased to 0.79%.

- The median annual wage for software developers was $132,270 in May 2023.

- The median annual wage for software quality assurance analysts and testers was $101,800 in May 2023.

- Employment has declined while developer pay has grown more slowly than overall U.S. wages. From January 2018 to January 2024, median base pay for developers rose by 24%, compared to 30% for all U.S. workers. Despite this slower growth, a software engineer’s salary is more than twice the national median salary.

- The U.S. Bureau of Labor Statistics projects that employment for software developers, quality assurance analysts, and testers will grow by 17.9% (much faster than the average for all occupations) from 2023 to 2033, adding approximately 303,700 jobs.

- Industry forecasts predict 140,100 job openings annually for software developers, quality assurance analysts, and testers from 2023 to 2033.

- Advancements in AI may reduce the demand for new hires, as Salesforce CEO Marc Benioff indicated that AI advancements could lead to a reduced need for hiring new engineers.

- Certain regions are experiencing fluctuations in tech employment. The unemployment rate in Seattle surpassed the national average in mid-2024, partly due to a decline in demand for information sector jobs, including software developers.

Software Development Work Environment Statistics

The software development landscape is continuously shifting, shaped by advancements in technology, changing industry needs, and evolving team structures.

As hiring trends evolve, big tech names and certifications don’t always guarantee technical excellence—and businesses must look beyond credentials to find the right talent.

The following statistics highlight trends in hiring patterns and demand for various developer specializations based on Lemon.io’s hiring and customer data:

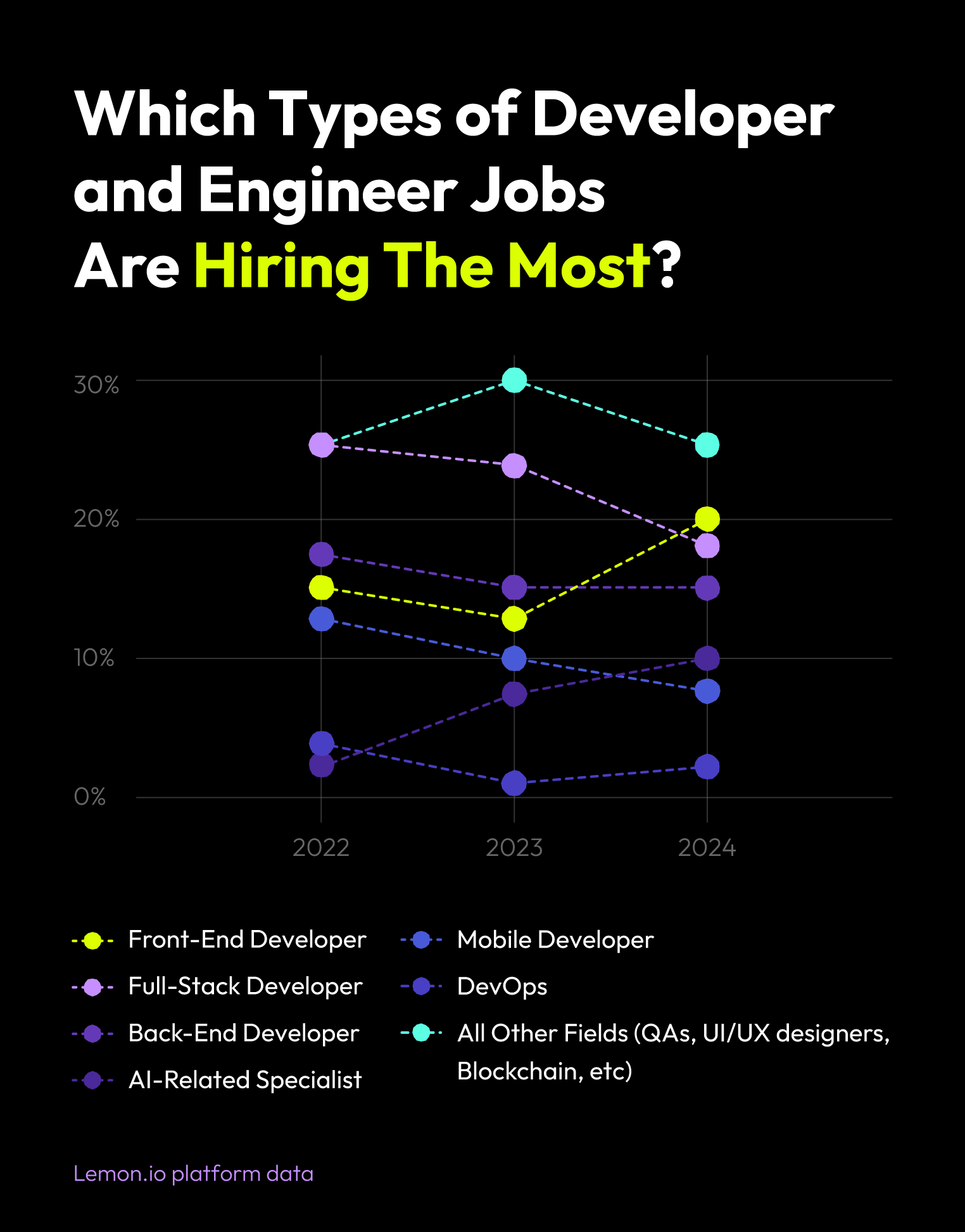

- The share of full-stack web developers hired decreased from 25% in 2022 to 19% in 2024.

- Hires for back-end web developers remained stable, dropping slightly from 17% in 2022 to 15% in 2024.

- There was a notable increase in front-end web developer hires, growing from 13% in 2023 to 20% in 2024.

- Mobile developer hires dropped from 13% in 2022 to 8% in 2024.

- DevOps hires saw a slight fluctuation, decreasing from 3% in 2022 to 2% in 2024.

- The demand for AI-related specializations (data science, machine learning, and AI engineers) grew significantly, from 2% in 2022 to 10% in 2024.

- Hires for all other roles (software quality assurance, UI/UX designers, blockchain specialists) fluctuated, starting at 25% in 2022, peaking at 30% in 2023, and returning to 25% in 2024.

The following insights from industry reports and third-party research provide a broader perspective on the evolving software development work environment:

- In 2023, software developers held approximately 1.7 million jobs, with the largest employers being computer systems design and related services (32%), software publishers (10%), finance and insurance (10%), manufacturing (9%), and management of companies and enterprises (5%).

- In 2023, software quality assurance analysts and testers held around 205,000 jobs, with the largest employers being computer systems design and related services (29%), finance and insurance (11%), software publishers (11%), manufacturing (8%), and administrative and support services (6%).

- More than half of U.S. software developers work in the professional and business services sector.

- Developer employment grew from January 2018 to November 2019, then began to decline. The employment index dropped 4.6% in January 2022, 3.5% in May 2022, and 3.4% in January 2023.

- Despite intermediate increases in August 2021 and October 2022, the developer employment index has been declining since 2020.

Software Development Age and Country Demographic Statistics

Understanding the age and country demographics of developers is essential for businesses looking to hire or collaborate with global talent.

The cost of developers and freelancers can vary based on factors like location and expertise. This section explores how these factors are influencing the global software development market.

The following Lemon.io back-end hiring data highlights the distribution of software developers across key markets in 2024:

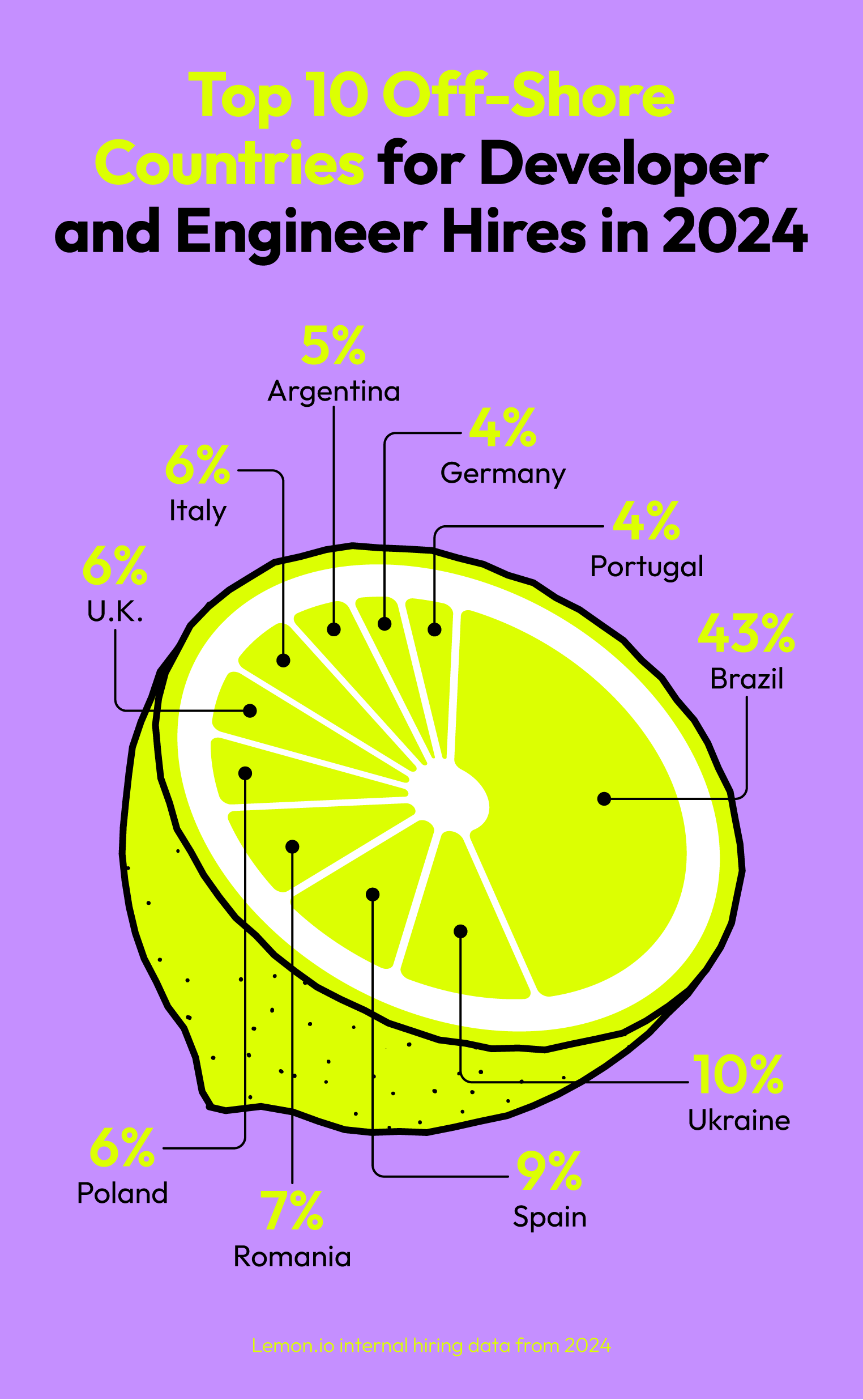

- Brazil has shown a dramatic increase in its share of software developers, rising from 10.1% in 2022 to 27.8% in 2024.

- Developers and engineers from Spain accounted for 5.6% of the talent pool in 2024.

- Romania held 4.8% of the global software development talent in 2024, reflecting its relatively consistent position in the market.

- The United Kingdom holds a 4% share of talent, securing its place among other key countries in the software development market.

- Argentina accounts for 3.2% of software development hires in 2024, indicating a steady rise in its role as a reliable source of talent.

- Germany contributed 2.4% of hires in 2024, showing a stable presence and steady demand for its software developers.

- Portugal also had a share of 2.4% of hires in 2024, showing a modest but steady presence in the global software development space.

The following industry reports and market analysis provide additional insights into global software development trends:

- The average age of male software developers is 39.2, while female developers have an average age of 38.5.

- The largest age cohorts among software developers were 30 to 34 (309,710 individuals), 25 to 29 (284,973 individuals), and 35 to 39 (271,772 individuals) in 2022.

- Detailed racial and ethnic data specific to software developers is limited. However, broader analyses indicate that the tech workforce continues to lack diversity, with an underrepresentation of Black and Hispanic workers.

- The Equal Employment Opportunity Commission found that less than 23% of tech workers were women in 2022, even though they make up nearly half of the U.S. workforce.

- Black workers made up 7.4% and Hispanic workers about 10% of the high-tech workforce, despite comprising 11.6% and 18.7% of all American workers, respectively. They were even more underrepresented in management jobs.

- The global developer population was projected to reach 28.7 million by 2024, an increase of 3.2 million from 2020.

- The United States is the highest-paying country for software developers, with a median annual wage of $132,270 as of May 2023.

Time and Cost of Software Development Statistics

Understanding the time and cost involved in software development can help businesses plan their projects more effectively. Knowing market rates and project timelines is helpful for learning how to hire software developers efficiently, especially when targeting the highest-paying software engineering jobs.

The following Lemon.io back-end data reflects current industry trends and averages for various software development projects:

- The typical software development project timeline for simple apps takes approximately one to two months to complete.

- Software development costs for a small software project or app range from $4,800 to $25,600 in 2025.

- Medium-sized software development project costs range from $14,400 to $64,000 in 2025.

- Large-scale, complex application software development project costs are $64,000 or more.

- Front-end developers cost $4,800 to $13,600 on average for a full month of work in 2025.

- Blockchain developers cost $6,400 to $14,400 on average for a full month of work in 2025.

- Full-stack developers cost $5,600 to $15,200 on average for a full month of work in 2025.

- The monthly salary range for a senior full-stack developer is $5,600 to $30,400 for simple projects in 2025.

- For medium-sized projects, the monthly salary range for a senior full-stack developer is $16,800 to $76,000 in 2025.

- For large-scale projects, the monthly salary for a senior full-stack developer is $76,000 or more in 2025.

Future Predictions for the Software Development Industry

Companies are prioritizing cost-effective solutions, automation, and scalable infrastructure to stay competitive. As AI takes on more coding tasks, the role of software engineers is shifting toward oversight, design, and optimization.

According to Lemon.io’s insights, the following trends are shaping the future of software development:

- Offshore development demand will continue to rise as companies seek cost-effective solutions from developers and engineers in countries outside of the U.S., like those in European and Latin countries.

- A surge in tech-enabled solutions that empower businesses to automate processes, increase efficiency, and streamline operations is inevitable—especially with AI and hiring overseas developers.

- We’ll see an accelerated shift to cloud-based infrastructure as businesses prioritize scalability, flexibility, and security.

Third-party insights also provide valuable predictions about the industry’s direction:

- Mike Krieger, co-founder of Instagram and current chief product officer at Anthropic, anticipates that software engineers will increasingly oversee AI-generated code, focusing on tasks like designing user interactions and reviewing AI outputs.

- AI agents manage 80% of customer interactions, leading to significant efficiency gains.

- The decline in demand for software engineers in the U.S. is partly attributed to AI enhancing engineers’ productivity, reducing the need for additional hires.

- Global IT spending will grow by 9.3% in 2025, with data center and software segments expected to experience double-digit growth rates.

Winning in a Competitive Software Market

The software development market is experiencing immense growth and new challenges. As global demand for software developers rises, companies must adjust to trends such as the growing need for AI expertise and offshore talent.

As businesses adapt to these changes, embracing new technologies and diversifying recruitment strategies, leveraging remote developers will be vital to maintaining a competitive edge in the evolving software market.

Get ahead of the curve and start hiring software developers through Lemon.io today.

Frequently Asked Questions

How Are Statistics Used in Software Development?

Software development statistics play a critical role in making hiring decisions and determining job roles. Companies and workers rely on data to assess the demand for specific skill sets.

What Percentage of the Population are Software Developers?

In 2023, North America was home to an estimated 1.6 million professional software developers. With 166 million people employed in the U.S., software developers represent 0.96% of the total workforce.

Which Country Is No. 1 in Software Development?

The United States is the leading country in software development in terms of the number of software developers, technological innovation, and annual salary.

The U.S. is home to a large portion of the global developer population, with significant contributions from major tech companies (Microsoft, Apple, Google) and a strong startup ecosystem.