Quick Answer:

There were approximately 4.4 million software engineers in the United States in 2023.

For founders, engineering leads, and hiring teams, understanding how many software engineers there are in the U.S. is key. This info can impact everything from sourcing strategy and salary expectations to hiring timelines and team structure.

According to recent data, the U.S. had about 4.4 million software engineers as of 2023. And Lemon.io’s client base is evidence of the global demand for ongoing software developers, with 68% in the U.S., 7% in Canada, 7% in Germany, 4% in Australia, 4% in the U.K., and 10% in other areas of Europe.

This number represents one of the world’s largest and most competitive developer talent pools. It spans full-time employees, contractors, and independent contributors across various industries.

In this report, we’ll explore the latest data on the number of software engineers in the U.S., how that compares to other regions, and what trends are shaping the tech hiring landscape going forward.

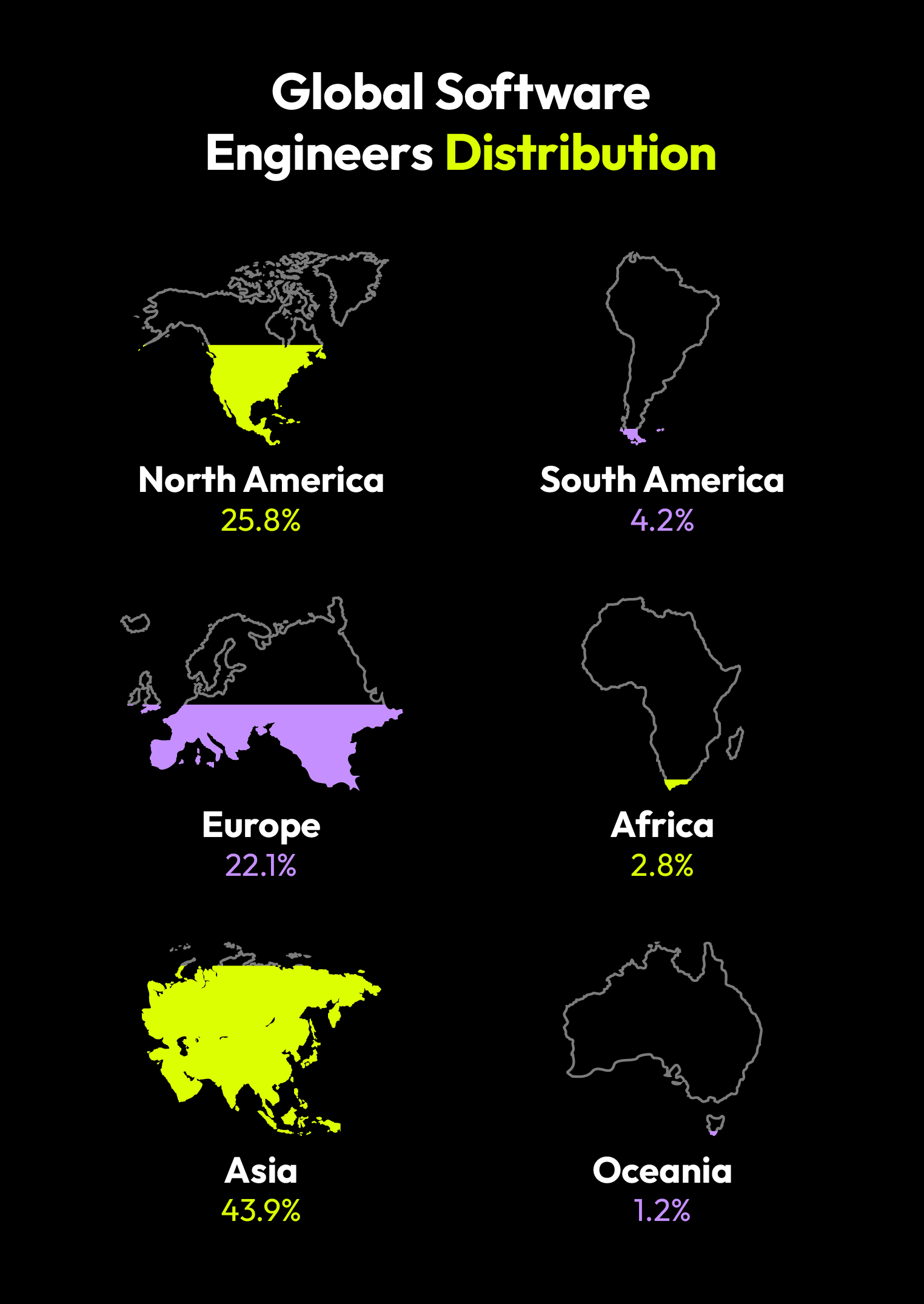

How Many Software Engineers Are There in the World?

According to JetBrains’ Global Developer Ecosystem report, there are approximately 20 million professional software developers worldwide as of 2024. This figure represents developers who are actively working full-time or freelancing in professional software roles.

When including part-time coders, hobbyists, and early-career developers, the total global population increases substantially. Based on SlashData’s 2025 Developer Nation survey, there are now 47 million developers worldwide, up from 31 million in 2022.

This broader definition reflects the expansion of developer communities across a wide range of industries and use cases.

Contributing factors include the rising demand for digital transformation, widespread adoption of AI-assisted coding tools, and increased technical needs in traditionally non-technical sectors.

For hiring teams, this global growth offers both opportunity and complexity:

- The talent pool is larger, but technical depth and project readiness still vary widely.

- Developers with experience in AI, DevOps, and cloud engineering remain in the highest demand.

- Even in a remote-first world, timezone compatibility and communication skills remain critical.

How Many Software Engineers Are There in Europe

As of 2023, Europe had around 6 million software developers, making it one of the most competitive regions in the global tech labor market.

This number reflects continued investment in digital infrastructure, rising demand for AI and cloud services, and the growth of the European startup scene.

Germany leads the way with approximately 837,000 software engineers, thanks to its long-standing dominance in enterprise software and manufacturing tech.

The United Kingdom follows closely behind, with estimates placing its developer workforce between 500,000 and 700,000, while France supports an additional 400,000 to 500,000 engineers.

These three markets form the core of Western Europe’s developer base, according to analysis from Radixweb and InApps.

Eastern Europe also plays a critical role in the continent’s software ecosystem. Countries like Poland, Romania, Ukraine, and Bulgaria now account for more than 1.3 million developers, fueled by strong STEM education systems and competitive labor costs.

According to JoinGenius, the region has become a prime destination for remote-first startups looking to scale teams quickly while maintaining quality. Firms like Dreamix report continued demand for nearshore partnerships as global hiring pressures rise.

Despite this growth, the European Union still faces a shortfall of roughly 500,000 software engineers, based on projections shared by SpringsApps.

Countries like Finland, Portugal, and Sweden are reporting particularly acute gaps in available talent, prompting many companies to expand their search beyond borders.

How Many Software Engineers Are There in South America?

South America is home to an estimated 2 million software developers as of 2024, a rapidly growing and increasingly strategic region for global tech teams.

NextIdeaTech reports that Brazil leads with approximately 759,278 developers, followed by Mexico at 563,075, Argentina with 167,414, plus 85,721 in Colombia and 59,111 in Chile.

Brazil’s software outsourcing market alone is valued at over $45 billion, making it a powerhouse in Latin American tech services. Over 500,000 of those developers are actively working in professional roles across the country, according to Toptal’s 2024 tech analysis.

Mexico adds approximately 220,000 to 245,000 developers, supported by strong government-led IT clusters and nearshore integration with U.S. companies.

According to Statista data, Argentina contributes around 115,000 developers, with Colombia adding another 62,000 and Chile contributing 61,000, as outlined in DevEngine’s LATAM hiring guide.

The region is projected to maintain 10-12% annual growth in tech services through 2030. Many U.S. startups and mid-market firms now rely on Latin American teams, especially in cloud, AI, and fintech, thanks to favorable time zones, quality talent, and cost efficiency, as noted by GridDynamics.

However, sourcing senior engineers remains a challenge, and quality can vary significantly by region.

For startups looking to scale quickly, partnering with vetted platforms or nearshore agencies is increasingly becoming the go-to strategy.

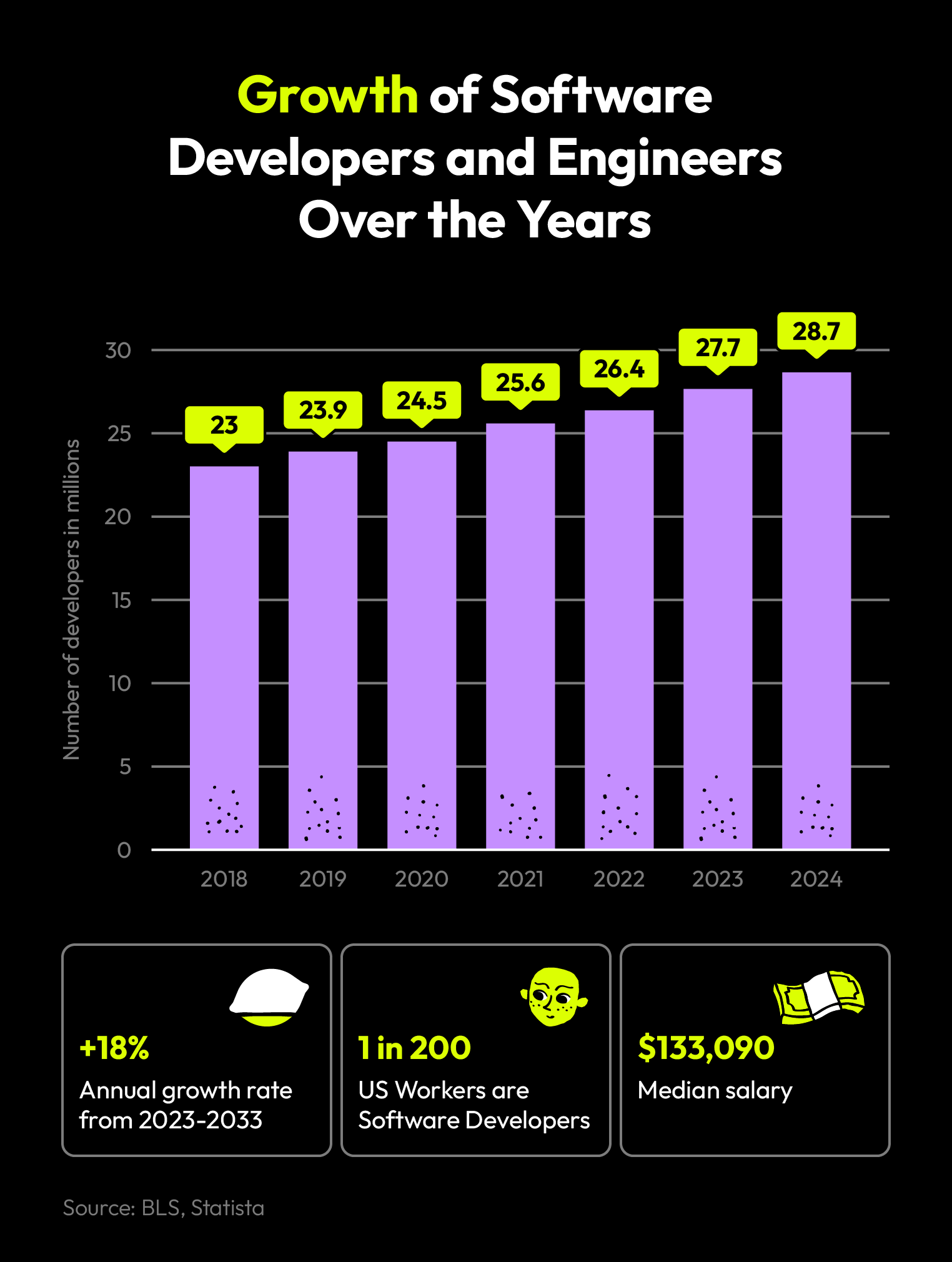

What’s Driving the Growth of Software Engineers in the US?

The resurgence in U.S. software engineering is powered by a perfect storm of technological transformation, shifting workforce dynamics, and strategic business bets.

Here’s a deep dive into the top drivers shaping the U.S. market for software developers in 2025:

1. AI, Automation, and Cloud Investment

U.S. companies are pouring billions into AI-first products, cloud platforms, and automation.

As Business Insider reports, tech firms are offering premium compensation, sometimes up to $200,000 extra, to secure AI and ML talent. This surge fuels demand for engineers who can build and maintain these systems.

Meanwhile, BLS data projects a 17% rise in software developer jobs from 2023 to 2033, driven largely by growth in high-paying fields like AI, cybersecurity, and cloud infrastructure.

2. AI Tools Boosting Dev Capacity

Some experts fear AI will replace engineers, but GitHub’s CEO recently clarified that AI actually accelerates productivity, creating more backlog, not less. With teams now shipping faster and more confidently, companies are hiring again to scale output.

3. Broad Digital Transformation Across Industries

Digital transformation isn’t just for tech firms; governments, healthcare providers, finance, retail, and manufacturing all now require bespoke software and integrations.

BLS highlights strong growth in computer systems services and IT consulting, adding 350,000 new jobs between 2023 and 2033.

4. Competitive Compensation and Retention Challenges

From 2018 to 2024, U.S. developer salaries increased by around 24%, slightly lagging behind general wage growth, making retention harder, according to ADP.

This pay pressure means companies are hustling with hiring a software developer via ongoing recruitment and competitive offers.

5. Shortage of Senior Talent and Skill Gaps

Despite high demand, America still faces a scarcity of experienced developers. Revelo’s May 2025 report highlights this gap and pushes global hiring and vetting to fill senior roles.

Entry-level positions, meanwhile, are affected by AI automation, reducing new opportunities.

6. Evolving Roles and Specialization

The nature of software engineering is changing. Skill sets around DevOps, security, data, and AI systems are becoming increasingly essential.

As BLS notes, occupations supporting data storage, IoT, and AI are growing faster than general developer roles.

What this means for hiring teams:

- Talent demand is accelerating across sectors, not just in tech.

- AI integration increases developer output and downstream workload, which drives higher hiring needs.

- Companies must offer strong compensation and benefits to retain engineers.

- Senior talent is in short supply, so hiring globally and emphasizing vetting can unlock access.

- Roles are becoming more specialized, requiring targeted sourcing strategies.

How Many Types of Software Engineers Are There?

The landscape of software engineering is incredibly diverse, with each role addressing specific technical layers, problem domains, or infrastructure concerns.

According to a recent overview by BrowserStack, there are more than 20 engineering specializations active in the market today, reflecting the complexity of modern software systems.

Here are the most common types you’ll encounter, each with its own focus:

- Front‑End Engineer: Builds user interfaces using HTML, CSS, and JavaScript to deliver responsive, interactive experiences.

- Back‑End Engineer: Develops server-side logic, APIs, and databases to power application functionality.

- Full‑Stack Engineer: Combines front and back-end skills to manage full application stacks from UI to database.

- QA Engineer / SDET: Designs and automates tests to ensure reliability and quality before release.

- DevOps Engineer: Bridges development and operations via automated CI/CD pipelines, infrastructure, and deployments.

- Security Engineer: Focuses on secure design, threat modeling, vulnerability remediation, and compliance.

- Data Engineer: Builds pipelines and storage systems to collect, process, and manage big data.

- Cloud Architect: Designs scalable systems leveraging public clouds like AWS, Azure, or GCP.

- Machine Learning Engineer: Develops production ML models and integrates them into applications.

- Site Reliability Engineer (SRE): Ensures system reliability and uptime by applying software principles to infrastructure.

Depending on the project or product needs, each of these roles can branch into niches, such as mobile, embedded systems, blockchain, gaming, or UX-focused development.

For companies hiring engineers, knowing which roles align with your technical roadmap is crucial for effective team building and targeted recruitment.

Challenges With Software Development Hiring in the US

Hiring software developers in the U.S. has become more complex, even as the overall tech market matures. Startups, mid-size firms, and even large enterprises are facing a combination of market pressure, talent imbalances, and shifting expectations.

Here are five of the biggest challenges shaping the hiring landscape in 2025:

- Competition for AI talent is driving up costs: Big tech companies are offering multi-million dollar compensation packages to recruit top AI engineers. As Meta, OpenAI, and other leaders race to dominate generative AI, smaller firms are getting priced out of the most in-demand talent.

- Junior developers are being squeezed out: Software engineering job postings in the U.S. have declined sharply since 2020, and most of the remaining roles target mid to senior engineers. Entry-level candidates are finding it harder to break in, especially as AI tools absorb simpler coding tasks.

- Turnover is high and expensive: Developer churn is a real concern. Annual turnover among engineers hovers around 23%, and replacing a single mid-level developer can cost up to twice their salary. For fast-moving teams, that creates a serious drag on velocity and morale.

- Hiring timelines are getting longer: The average time-to-hire for a software engineer has stretched out, especially for roles that require knowledge of cloud infrastructure, DevOps, or AI integration. Companies are more selective, and candidates expect more flexibility and autonomy.

- There’s a shortage of senior technical leadership: While generalist engineers are easier to find, senior developers with deep experience in system design, security, and site reliability remain scarce. This shortage often delays key initiatives or forces teams to outsource critical architecture decisions.

These challenges aren’t insurmountable, but they do require better planning, a clearer sourcing strategy, and sometimes a broader geographic reach.

“Offshoring can give companies access to thousands of talented developers in Europe — but only if you work with a partner who thoroughly vets their talent pool. Quality and reliability shouldn’t be sacrificed just to save on hiring costs.”

Top Alternatives to Hiring Software Engineers in the US

With rising salaries, limited senior talent, and longer time-to-hire timelines in the U.S., many startups and growing teams are exploring alternative ways to scale their engineering efforts.

Whether you’re trying to meet a tight deadline, reduce overhead, or access specialized expertise, there are proven options beyond traditional in-house hiring.

Here are three of the most effective alternatives:

Nearshore and Offshore Development

Hiring outside the U.S., either nearshore or offshore, has become a go-to strategy for companies looking to balance cost with quality.

Nearshore development typically refers to working with teams in nearby time zones, like Latin America or Eastern Canada, while offshore development often involves engineers in regions like Eastern Europe, India, or Southeast Asia.

Nearshore models offer tighter time zone alignment, easier communication, and stronger cultural compatibility. Offshore teams, meanwhile, often deliver cost savings of 40-60%, making them ideal for long-term, budget-conscious projects.

Many platforms, including Lemon.io, offer pre-vetted engineers from these regions so that companies don’t have to compromise on skill or security.

Freelancers and Contract Engineers

Freelancers and independent contractors are a flexible option when you need to solve a specific technical problem, run short-term projects, or fill temporary gaps in your team.

This model is especially useful for startups that don’t have the time or budget for a full-time hire but still need senior-level output.

Freelance platforms have evolved significantly. Today, companies can hire experienced developers who bring deep knowledge in web development, DevOps, AI, mobile, and more often within a few days.

The key is finding platforms that properly vet their talent to avoid risky trial-and-error hiring.

Outsourcing to Development Agencies

If you’re building a large project with lots of moving parts, or if your team lacks the internal project management to coordinate multiple freelancers, working with a full-service development agency can make sense.

These agencies typically offer end-to-end solutions: product planning, design, engineering, QA, and long-term maintenance.

The biggest benefit here is predictability. You’re not managing multiple engineers or handling hiring logistics yourself.

The downside?

Agencies are typically more expensive than freelancers or offshore developers. But for teams that need speed, structure, and a polished product, the investment often pays off.

Hire Engineers Outside the US With Lemon.io

When considering how many software engineers are in the U.S., it’s clear the market is large, but also crowded, costly, and increasingly hard to navigate.

For many companies, the next step is to look beyond national borders. If you’re exploring global hiring options, this guide to hiring software developers breaks down what matters most.

Lemon.io helps startups and growing teams connect with vetted, remote engineers from trusted global markets. Every developer is screened for technical ability, communication skills, and reliability, so you get the right fit, fast.

Scaling your team shouldn’t mean lowering your standards. Hire engineers through Lemon.io and confidently build your next product, no matter where your engineers are based.

FAQ

What Percentage of the US Population Are Software Engineers?

With around 4.4 million software developers and a U.S. population of roughly 334 million, software engineers make up about 1.3% of the total population. If we narrow it to the workforce, the share rises to about 2%, placing tech talent among the most sought-after professionals nationwide.

Are Software Engineers in Demand in the USA?

Yes. Software engineers remain in high demand. The Bureau of Labor Statistics projects 17.9% job growth for software development roles from 2023 to 2033, driven by AI, cloud, digital services, and automation expanding across all industries.

Does the US Have a Shortage of Software Engineers?

Absolutely. The shortage of experienced and senior engineers is creating a hiring gap. Reports indicate the U.S. faces a shortfall of 1.2 million developers by 2026, especially at higher levels, prompting many companies to tap global talent pools for solutions.